The Smiths, Einstein, and HELOC's

We’re excited to host our son, Humberto Jr., for this two part series on real estate and financing. This blog post is especially helpful for clients thinking about using a Home Equity Line of Credit (HELOC) for their next renovation. Let's jump right in!

Humberto Jr.

Humberto Jr.'s career began on the ground floor, so to speak, as an installer and sub-contractor at Humberto’s Flooring. He now serves as a Mortgage Loan Officer and REALTOR® at Home Pride Real Estate. Additionally, is the Co-Founder of UCLA’s Value Investing Program and an Adjunct Professor of Economics at Cerritos College. He is passionate about helping families achieve their goals, especially through real estate investing and construction.

Leveraging the HELOC

Albert Einstein famously said, "Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn't, pays it." This profound quote clearly illustrates the essence of leveraging good debt, especially as a consumer and not as a bank. Consider the Smiths, a family residing in the heart of Santa Clarita. They own a beautiful, 2,000s.f. home valued at $700,000, with an outstanding mortgage balance of $490,000. They have this incredible vision to renovate their entire home - upgrade the flooring, refurbish the kitchen, repaint the walls, and revamp the bathrooms. Instead of depleting their savings, they opt to leverage the equity in their home, utilizing a home equity line of credit (HELOC) to finance their renovation.

Based on average renovation prices (Homewyse.com), a full-scale interior makeover would cost ~$70,000:

Flooring $18,000

Paint $10,000

Kitchen $24,000

Bathrooms $18,000

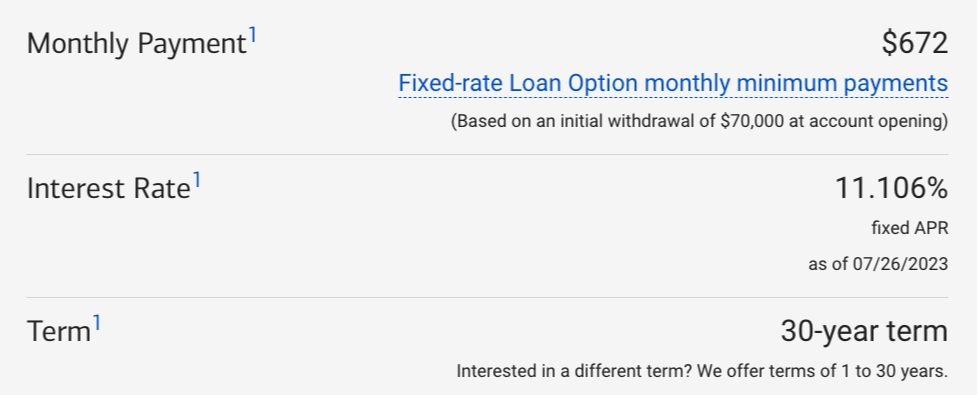

The max HELOC line the Smiths would qualify for is $105,000, although they don’t need to deploy that full amount. They tap into their HELOC line for the $70,000 required for renovations and end up with an additional monthly payment of $612/month (variable rate) or $672/month (fixed rate).

Granted, ~$600/month is a significant monthly expense. But let’s dive deeper into the not-so-obvious, positive consequences:

Home Value Appreciation - a turn-key 2,000 s.f. Santa Clarita home is valued at approximately $820,000 (Redfin, July 2023). This means that a $70,000 renovation can potentially create +$50,000 in additional equity. Not bad for an additional ~$600/month, especially since the turn-key home would cost approximately $5,588/month (Assuming 20% down and 30-year fixed interest mortgage loan at 7.5%).

Tax Benefits - HELOC interest payments can be tax deductible, which helps the Smiths save on their federal income taxes. With a ~$600/month payment, the Smiths will likely deduct interest payments when filing their taxes next year (please consult your tax professional for specific advice).

Flexibility - While the Smiths are locked into their original mortgage loan payment, they can adjust their HELOC payments as needed based on their circumstances. One example is the option of switching from a variable to fixed interest rate or vice versa. Additionally, should the Smiths receive an additional income source or accumulate additional savings, they could pay off the HELOC principal to reduce their monthly payment.

ConclusionAs you delve into the realm of home renovations and financing, it's critical to remember that each client's financing profile is unique to their situation. Numerous factors come into play, from credit scores to the original mortgage balance, that can significantly influence the outcome.

I hope these HELOC insights have been helpful! I encourage you to explore the transformation journey of one of my very first clients who leveraged up in Canyon Country, CA (floored of course by Humberto's Flooring). Like my parents, I personally believe in a trust-based approach that helps my clients reach their long-term financial goals. So please, don't hesitate to reach me with any additional questions and happy renovating! 🔨🛠️✨

- Humberto Jr.